The Thought Police Have Arrived

Our freedoms are being trampled under the guise of 'safety', but it's all about control, as George Christenson points out.

Powell just told the market that 'yields are too damn high'...

Tl;dr: Powell just told the market that 'yields are too damn high'.

So Chair Powell basically told traders...

The bigger than expected QT taper announcement juiced markets (stocks and bond prices up, dollar down) into Powell's press conference, then got spooked lower as he admitted "inflation has shown a lack of further progress... and gaining confidence to cut will take longer than thought."

By the mkt close, all of Powell's pig-kissing lipstick had been wiped off as US stocks saw solid gains erased in the hour after Powell stopped speaking... Small Caps and The Dow managed to hold on to the gains but Nasdaq and S&P closed nearer the day's lows...

Finally, rate-cut expectations (hawkishly) rose on the day with one-or-two cuts in 2024 now 50-50 and two-or-three cuts more in 2025 around 50-50 also.

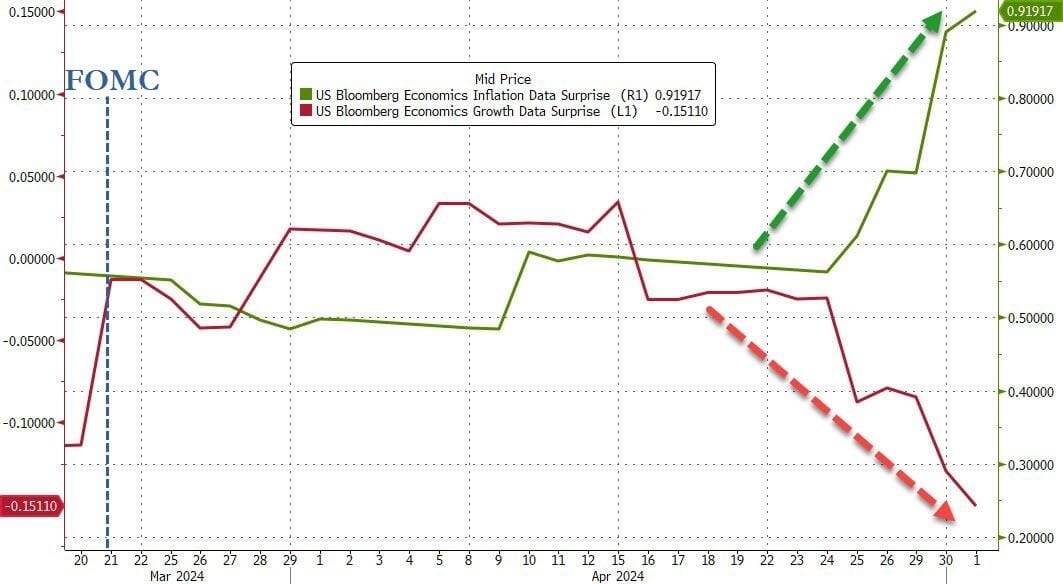

And, also Powell explained that he "doesn't see the stag or the 'flation" in markets... well this should help Jay...

I can't help but feel like Powell is awfully eager to 'loosen' policy... but he made it clear that the 2024 election "just isn't a part of the Fed's thinking."

So, that's that then!

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).