Yellow Brick Road to Irrelevance

The Liberal Party are seen as naaive, lacking courage, heartless and politically brainless. Their latest move confirms the worst.

US Stocks Gain As Senate StopGap Trumps Hindenbergs, HawkSpeak, & Hard-Data 'Bad News'

So more FedSpeak overnight - singing from the same 'more hawkish than the market expects' hymn-sheet - as Fed Member Bostic reiterated his expectation that rate-cuts won't begin until the third quarter.

“In such an unpredictable environment, it would be unwise to lock in an emphatic approach to monetary policy,” Bostic said in prepared remarks Thursday at an event hosted by the Atlanta Business Chronicle.

“That is why I believe we should allow events to continue to unfold before beginning the process of normalizing policy.”

“My outlook right now is for our first cut to be sometime in the third quarter this year, and we’ll just have to see how the data progress,” Bostic concluded.

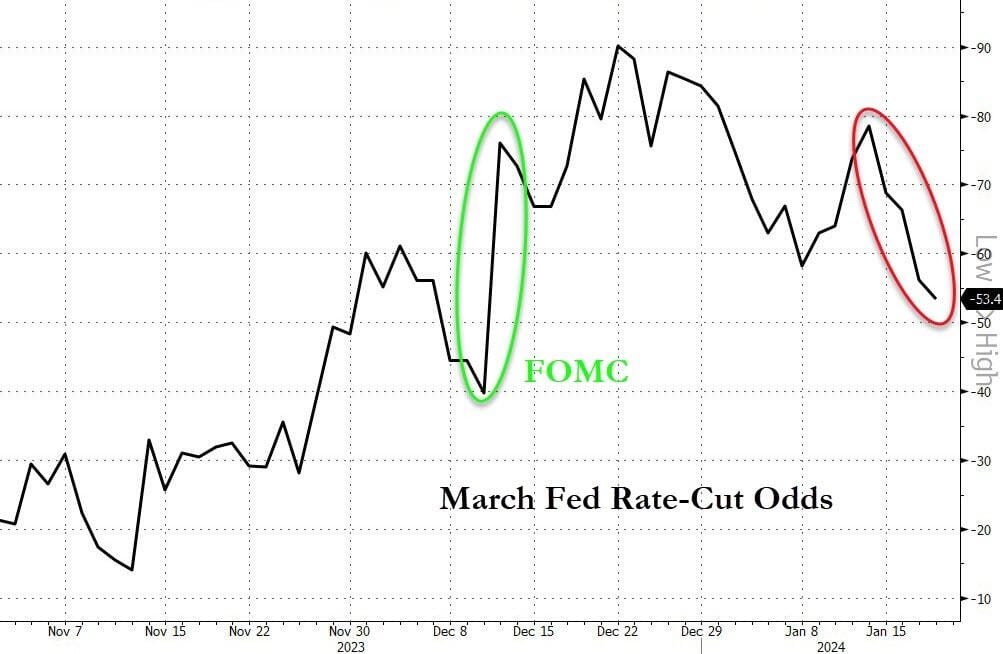

This sent the odds of a March rate-cut lower still...

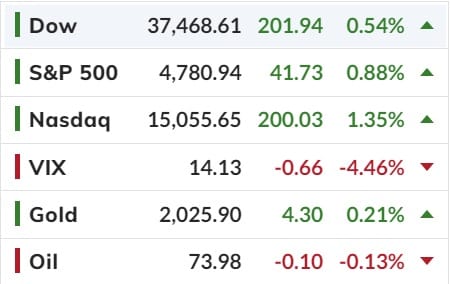

The Senate passed a stopgap funding bill to keep the government open, which prompted an immediate buying spree in stocks, lifting all the majors into the green (with Nasdaq notably outperforming and Dow and Small Caps the worst gainers)...

MAG7 stocks soared to a new record high...

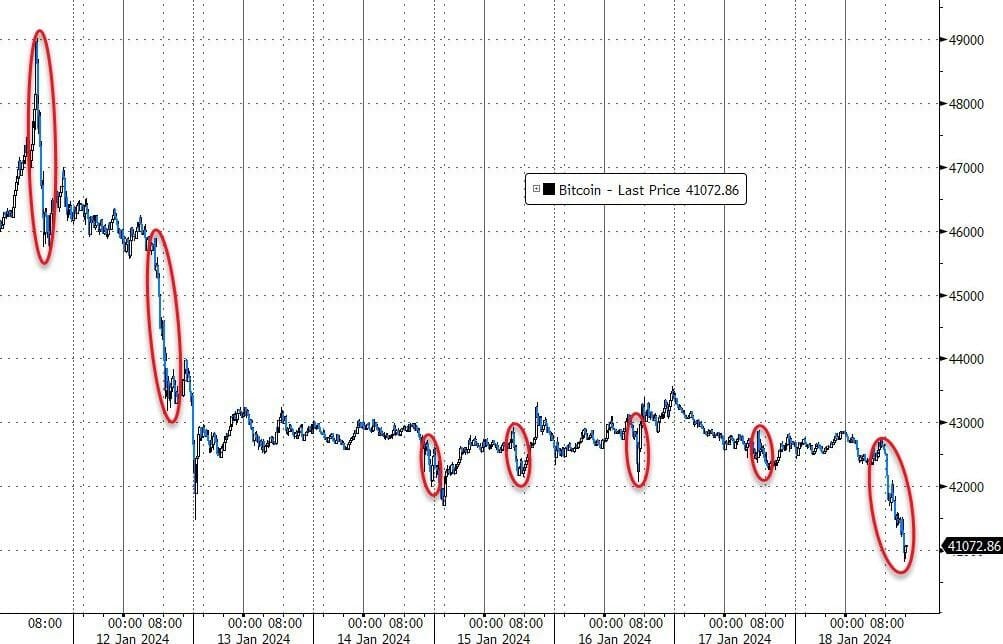

But, while stocks swung around wildly, Bitcoin was a one-way street lower after the ETFs opened... again...

You would think after Investors poured $1.9 billion into nine new exchange-traded funds tracking the spot price of bitcoin in their first three days of trading would have been a positive for Bitcoin price but you'd be wrong. The 40,000 pound Gorilla - the Grayscale Bitcoin Trust (GBTC) which is 40X bigger in market cap than the Blackrock ETF (IBIT) has seen significant outflows this month. The trust was converted into an ETF at the same time the other ETFs were launched, and has seen $1.16 billion in outflows in its first three trading days hence why the spot Bitcoin price has been sinking and not rising.

Bitcoin is now back at its lowest since the start of December...

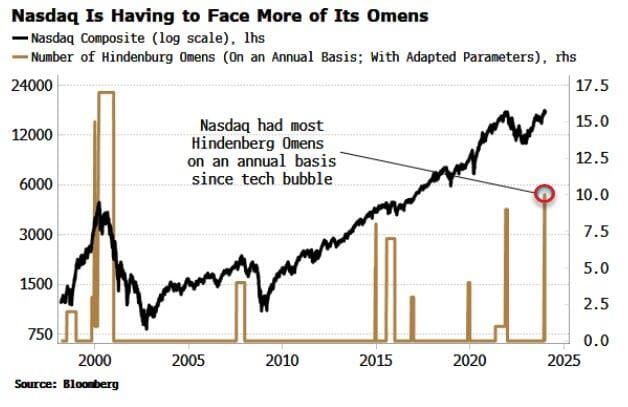

Finally, I note that the frequency of Hindenburg Omens is increasing significantly...

"Probably nothing!"

Have a good weekend!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).