EP 50 of the ANDIKA BULLETin

How Did Your Super Perform in FY 24/25? ME: 67.5%

So i appear to be finally getting over the current flu/cold bug that has been going around. Never got tested so not sure what i had but it nearly 6 days of nasal congestion is to put it mildly - annoying.

I'll also be brief as not much to report.

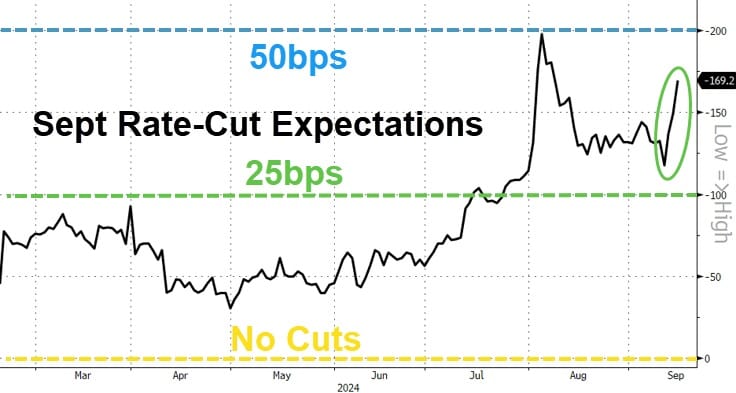

Everyone is waiting for Sept 18 US time so Sept 19 our time to see just how much the US Fed cuts their interest rates.

Basically the mkts are suggesting there is a now a 70% chance of a 50 bps rate cut.

But there is a ZERO per cent chance of any rate cuts here in Australia!

Remember US stocks (Nasdaq 100 in this case) and bonds remain decoupled (the latter thinking 'recession' and the former focused on 'rate cuts to save the world')...

The reflexive dichotomy of those two arguments may well come unglued after Powell makes his decision this week - 25bps or 50bps!?

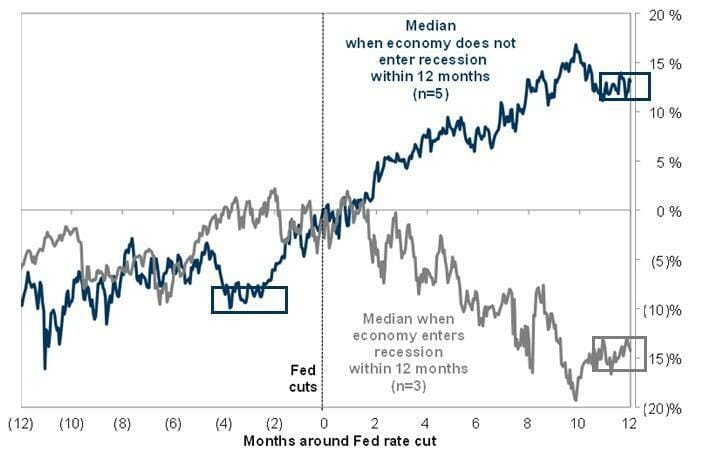

So the performance of the market during an easing cycle ultimately depends on the final destination.

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).