A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

Gold Soars to Record High, US Dollar Dumps as Kommiela unveils 'Populist' Economic Plan while Global Debt hits a new high of USD$315 Trillion

We are sure it's just a coincidence...

...on the day that Kamala Harris unveils her price-fixing, vote-buying agenda for economic growth...

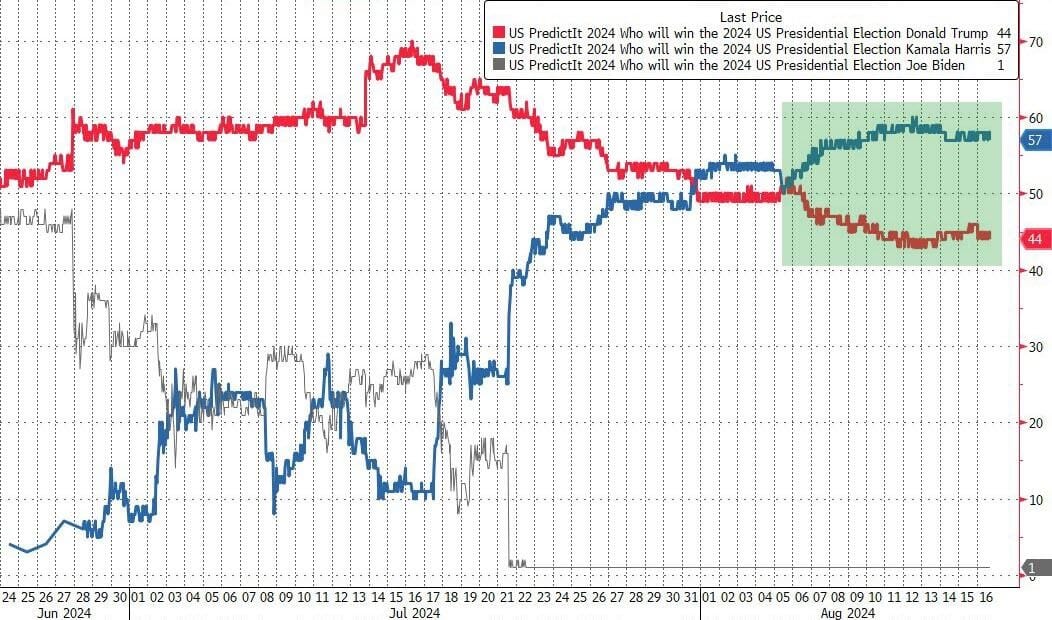

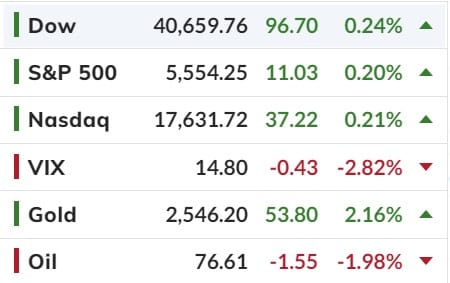

...as gold soared to a record high, topping USD$2,540 for the first time while the USD plunged to 5 month lows because it appears Kamala is over taking Trump in the poll prediction markets.

Basically she just admitted Americas are still suffering from the severe effects of the Biden Harris regime and now she want four more years?

US equities also soared this week to their best week of the year, led by a a 5%-plus surge in the Nasdaq (up 12% from last Monday's lows)...

Locally, the ASX200 also surged higher last week following important local and overseas macro-economic news that brought the “Goldilocks Trade” back to life and, with it, the aussie stock market

Local reporting season dominated the ASX on the stock level with good old-fashioned fundamentals at their rightful place, determining the path for equities:

Winners: Zip (ZIP) +24.8%, Magellan (MFG) +15.3%, JB Hi-Fi (JBH) +14.9%, Lovisa (LOV) +10%, Evolution (EVN) +8.8%, AGL Energy (AGL) +8.8%, and Commonwealth Bank (CBA) +6.6%.

Losers: Cochlear (COH) -9.7%, NEXTDC (NXT) +9.3%, Nufarm (NUF) -8.6%, Origin (ORG) -7.9%, Beach Energy (BPT) -7.7%, Fortescue Ltd (FMG) -6.2%, Aurizon (AZJ) 4.4% and Amcor (AMC) -3.2%.

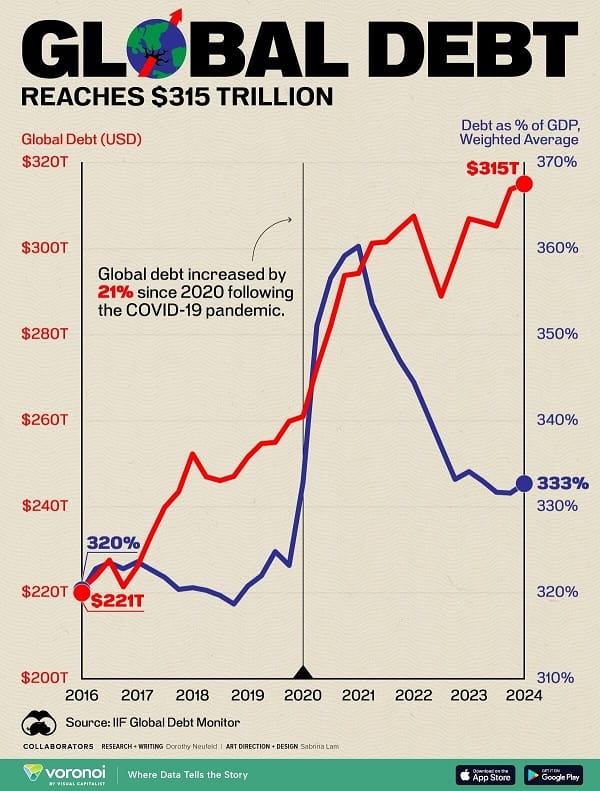

Meanwhile, The global debt hit a new record in the first quarter of 2024, increasing by USD$1.3 trillion in just three months, to an eye watering and all-time high of USD$315.1 trillion, equivalent to 3.0x world GDP!!!

This deluge in borrowing is a widespread trend across economies.

While the U.S. and Japan were the largest contributors across advanced economies, China, India, and Mexico drove the largest share in emerging markets.

Overall, the global debt-to-GDP ratio reached 333% as higher debt servicing costs and growing debt burdens continue piling up.

I trust everyone knows there is no way this massive debt will ever get repaid. Sooner or later the house of cards debt will come tumbling down.

Have a great weekend!

Please note no ANDIKA BULLETin on Monday.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).