Welcome Aboard!

George Christensen is now walking the corridors of power as a fearless journalist. I am pleased to announce a new collaboration.

Gas, US Dollar & Yields Soar as Fed-Fears Trump WW3 Worries

Mixed data overnight out of China (GDP beat, Retail sales & Industrial production miss) was matched by an equally divergent overnight of macro in the US with ugly housing data but strong industrial production, but once again the markets were ping-ponged by Fed fears (rate-cuts-off - Fed Vice-Chair Jefferson and Powell both sang from the same 'higher for longer' hymnsheet with the latter finally admitting that "recent [inflation] data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence") and MidEast tensions (WW3-on, but not yet - Israeli war cabinet plan is 'keep Iran guessing').

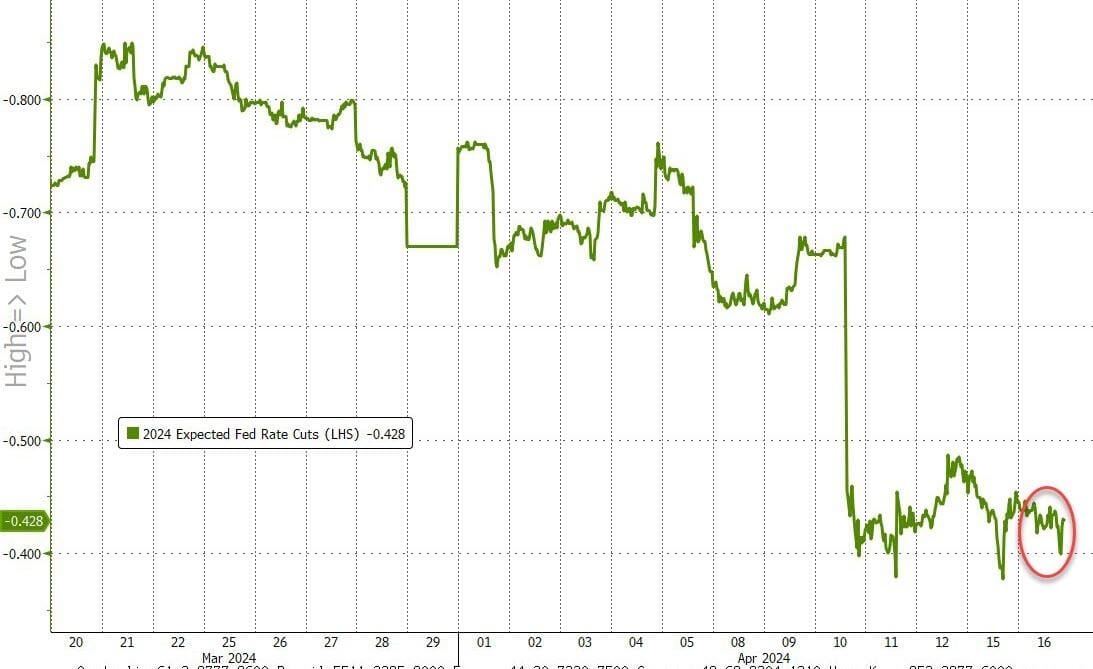

All of which pushed rate-cut expectations lower in the US...

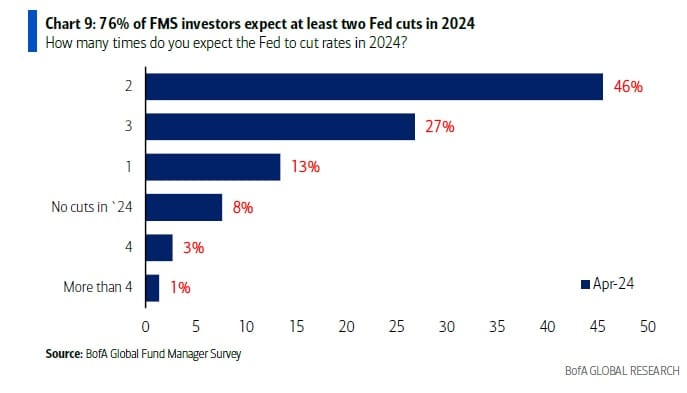

In fact, the majority of investors now see 2 rate-cuts this year...

And the odds of a possible 1st June rate- cut have tumbled to just 15% which IMO won't happen.

The US 2Y yield is also back over 5% while the US 10Y is now around 4.66%

Stocks were volatile today amid the surge in yields and Powell's comments, with Small Caps lagging in the red along with a small loss for the S&P and Nasdaq unch. The last minute saw a big sell program hit to ruin most people's day...

The only real notable mover overnight was the US Dollar - trading to fresh highs since NOV2023 and the chart has formed a Golden Cross which is a bullish indicator suggesting the USD could move higher which means the AUD could fall below 64 US cents

Oil and Bitcoin ended essentially unchanged while Gold managed small gains to reach a new record high price of US$2,448.80 (it has since fallen back to just under US$2,400

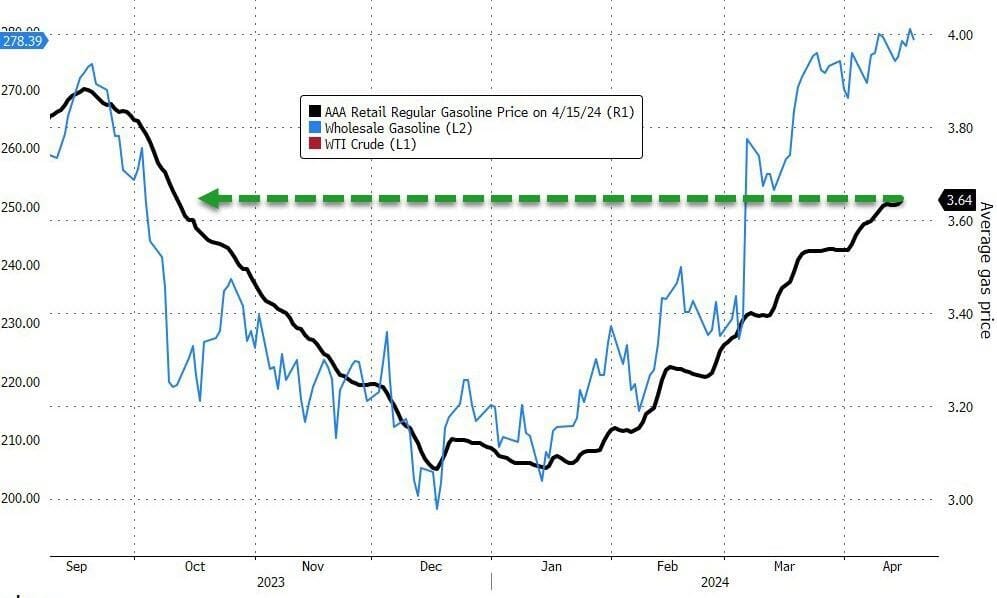

Lastly, now wonder the chances of a US rate cut have taken a dive - check out US Gasoline (petrol) prices.

Nuff said...

Take it easy

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).