ANDIKA BULLETin 16 MAY 2024

Soft CPI Sparks Run To Record Highs For US Stocks; Bonds, Bullion, & Bitcoin All Bid. US Consumer Prices Have Risen Every Month Since 'Bidenomics' Began, Up 19.5% To Record High!

Tl;dr - Nothing good - all bad... and new record highs for US stocks.

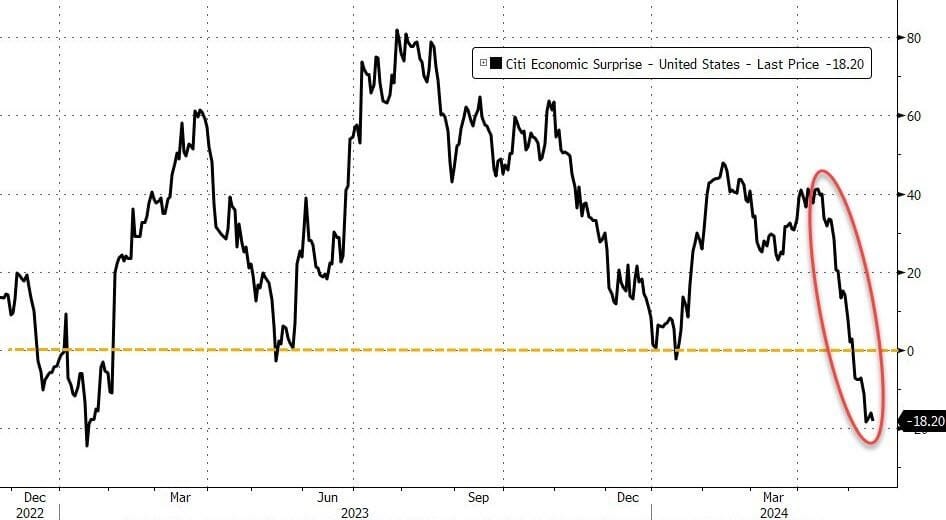

SuperCore CPI hotter than expected (but headline and core CPI in-line/small miss), Retail sales way uglier than expected (but gas station spending surged), homebuilder sentiment slumped, and Empire Fed Manufacturing ugly...

So after a fourth straight month of hotter than expected PPI, analysts' expectations for CPI were tightly ranged around 0.3-0.4% MoM and printed +0.3% MoM (slightly below the 0.4% expected). The YoY headline CPI fell to +3.4% as expected from +3.5% prior.

And the main stream media won't tell you this - that consumer prices have not fallen in a single month since President Biden's term began (July 2022 was the closest with 'unchanged'), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump's term). And prices have never been more expensive.

That is an average of 5.5% per annum (more than triple the 1.9% average per annum rise in price during President Trump's term).

The US market doesn't care about growth - it's high on rate-cut expectations especially after the 'cool' CPI (two cuts fully priced in for 2024 and three more cuts - at least - in 2025).

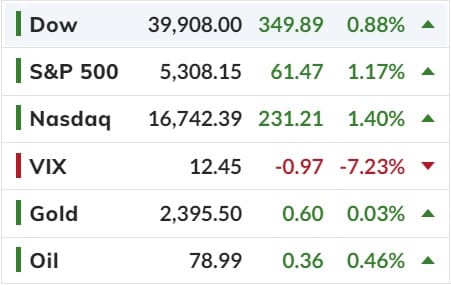

And that lifted stonks across the board with Nasdaq leading the way to new record highs (Dow & S&P first new record close since March)

Meanwhile the VIX crashed down to 12 handle, yields across the board were down and the USD was down (Aussie up nearly to USD67c)

Gold, Bitcoin all surged with Bitcoin having its best day since MAR2023!!

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).