A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

Unreal...

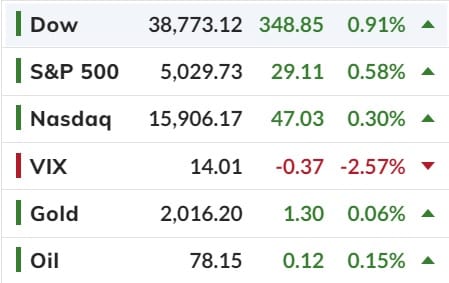

A Japanese recession (and new equity market highs) and a UK recession (and rising stock market) and broadly crap US macro (and stocks soar) - we're sensing a pattern.

'Good' jobless claims data was not enough to deter the momo-muppets from the 'bad' retail sales data, and 'ugly' manufacturing print that all provided just the ammunition for bulls to hope for The Fed to rescue them sooner rather than later (and with more).

March remains off the table but May is back up to a 33% chance of a cut and 2024 now back up to 4 rate-cuts...

Small Caps were up 2.5% overnight (as the Nasdaq lagged) pushing it well above pre-CPI levels. The Dow managed to get back to even from CPI...

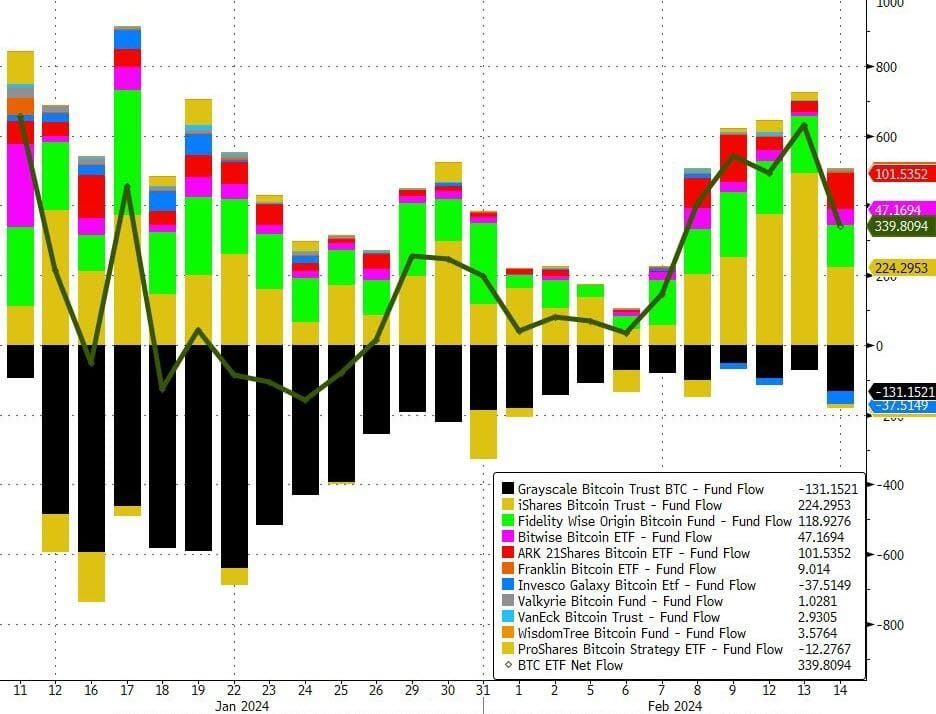

MAG 7 stock actually went nowhere (for a change), while the USD dumped (AUD up!), while Bitcoin rallied overnight near USD$53K while Inflows continued to extend but a slower clip.

And you'll never believe what anti-Bitcoiner Senator Elizabeth 'Karen' Warren just did...

After years of vilifying Bitcoin as money for criminals, terrorists, and climate change deniers, Senator Elizabeth Warren (D-MA) honored Satoshi Nakamoto for the 15th anniversary of the network’s launch with a commemorative flag flown over the United States Capitol, unveiled by NYC's PubKey.

what prompted this full 180 in her views of bitcoin is unclear but speculation is centering on three main threads:

1) Uber-lefty, globalist donor Larry Fink (whose company BlackRock now maintains 109,000 BTC - worth ~$6 BN - under its new ETF) tapped her gently on the shoulder about how much money can be made from rent-seeking on this stuff...

2) Polls suggested she is on the wrong side of history with regard to personal sovereignty and voters matter (to some degree)...

3) CBDCs are imminent and somehow bad-mouthing this blockchain-backed asset does not align with the centralized power and control that a Digital Dollar would give her and her pals.

Finally, we are in wonderment that this 'commemoration' comes less than 24 hours after a US Treasury official admitted that terrorists are not using crypto to blow the world up, they prefer the good ol' US Dollar for that.

Meanwhile, mega-bank JP Morgan has officially left eco-loon Climate Action 100+ Group.

Peak ESG and related synonyms, such as "climate change" and "clean energy" and green energy" and net zero," among other terms, peaked at 28,000 mentions in the first quarter of 2022. Ever since, the number of mentions has rapidly plunged. Halfway through the first quarter earnings season, mentions are around 4,800.

Finally, Zero Hedge pointed out last year how the ESG grift was reaching endgame after Markus Müller, chief investment officer ESG at Deutsche Bank's Private Bank stated that sustainability funds should include traditional energy stocks, arguing that not doing so deprives investors of a prime opportunity to invest in the transition to renewable energy.

So funny!

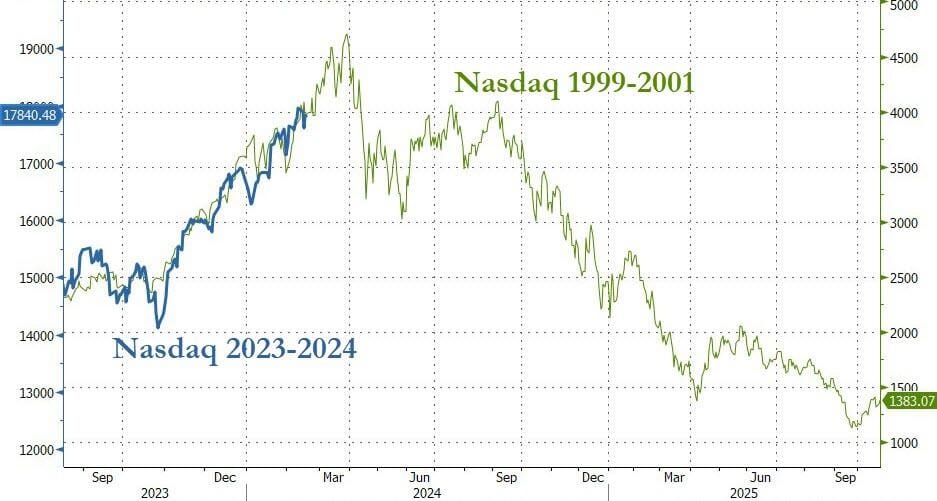

And this has to be the best metaphor of the current US Tech mkt melt-up. Check this yearly chart of Super Micro Computer (SMCI).

RSI @ 99! WTF!

There is definitely a growing feeling of exuberance and 1999 about the current markets.

Happy Friday!

Take it easy

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).