AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

Rumours from China that authorities will issues 6 trillion yuan in bonds to support stimulus plans prompted talk of the inevitability of a China QE to maintain bond yields... and that QE talk sent stocks and crypto soaring.

Bitcoin soared higher on the China QE hopes, topping $66k (its highest since late-Sept) (about AUD$98K) overnight while the USD continued its charge higher to two-month highs.

Despite the US dollar strength, gold held on to recent gains.

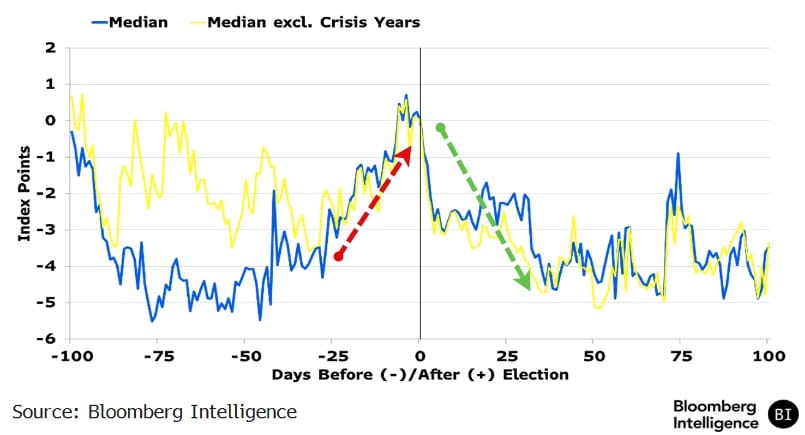

And this is interesting. Finally, as Bloomberg reports, investors are hedging more during this record run for stocks that they did in the first half of the year, boosting options volatility and put skew well above realized levels. There’s plenty of reasons for caution -- the US election, the uncertain pace of Federal Reserve interest rate cuts (with a meeting in early November), Middle East tensions to name a few. It’s not unusual for volatility to elevate at this time of year.

The historical pattern during election years is for the VIX index to keep edging higher until late October before falling through the end of the year, according to Bloomberg Intelligence.

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).