A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

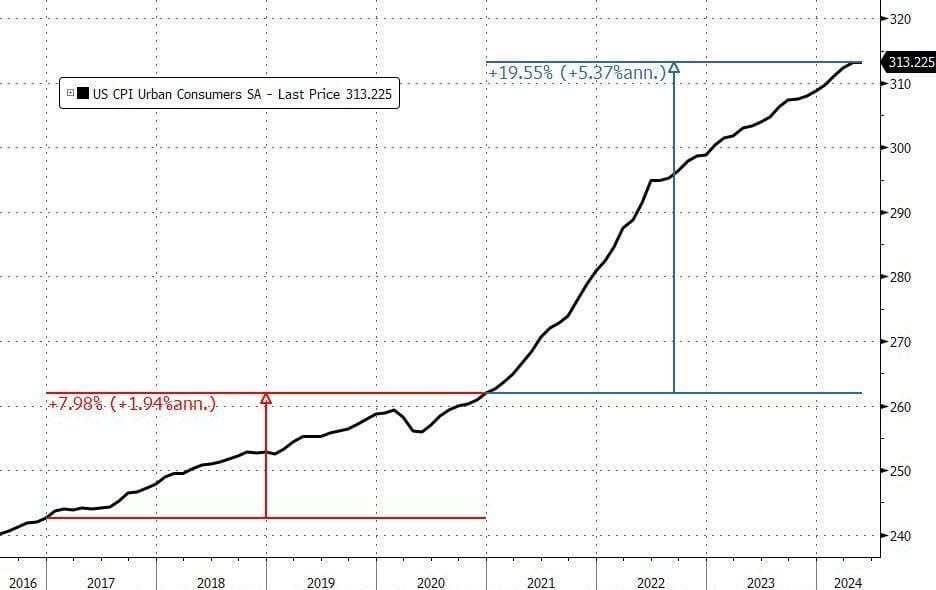

US Consumer Prices Hold At Record Highs - Up 20% Since Biden Elected while Hawkish 'Dots' Spoil Markets' Soft-CPI Party

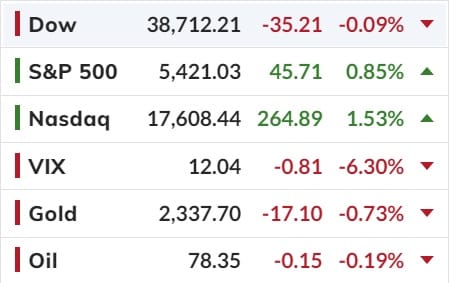

Soft a CPI (bad data?) sparked a melt-up in stocks, bonds (prices), gold, and crypto which held in place until The Fed statement which sent a more hawkish message to markets than was expected.

There were 10 Fed members who saw rates at 4.625% or below by end 2024 (implying at least 3 cuts) in March2024... now there are none...

Sticky inflation.

The headline consumer price index was unchanged MoM in May - the smallest change since July 2022 - just less than the +0.1% MoM expected. On a YoY basis, headline CPI rose 3.3% (less than the 3.4% exp) - but very much stuck in a range well above the 2% target for over year now.

But some 'good' news in the sense that Core CPI rose 0.2% MoM (below the 0.3% exp) pulling the YoY change down to 3.4% (from 3.6% and below the 3.5% exp). That is the lowest Core CPI YoY since April 2021.

BUT, Core CPI has not had a down-month since President Biden was elected.

I note that consumer prices have not fallen in a single month since President Biden's term began (July 2022 and May 2024 was the closest with 'unchanged'), which leaves overall prices up over 19.5% since Bidenomics was unleashed (compares with +8% during Trump's term).

And prices have never been more expensive...

That is an average of 5.4% per annum (almost triple the 1.9% average per annum rise in price during President Trump's term).

Will the next President and Fed head face a 70s redux?

And is this guaranteed if Powell decides "insurance" cuts are required (for Biden?)

Chair Powell doesn't completely shut the door down for a September cut, but his pushback was quite soft in my opinion. He used to say "SEP is just a forecast, everyone can have their opinion," but not this time.

We shall all see in good time...

So US stocks finished higher in which the S&P 500 and Nasdaq extended on record levels.

USD dropped so the AUD was up (to around USD$0.6662) while Bitcoin after initialling hitting over USD$70K reversed all the gains thanks to the hawkish Fed statement.

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).