Australia’s Bureaucratic Blanket

The bureaucrats are smothering the nation’s spirit as the entrenched and privileged elite grow in power.

Overnight US trade saw the 45th all-time-high of the year, but none of the prior 44 have occurred alongside this elevated a level of volatility; this will be the first week of the year where the VIX has closed above 20 every day, and so ongoing elevated risk is expected as we progress through October.

Despite the dollar strength, Gold extended yesterday's rebound to end the week $35 higher, finding support at USD$2675 once again.

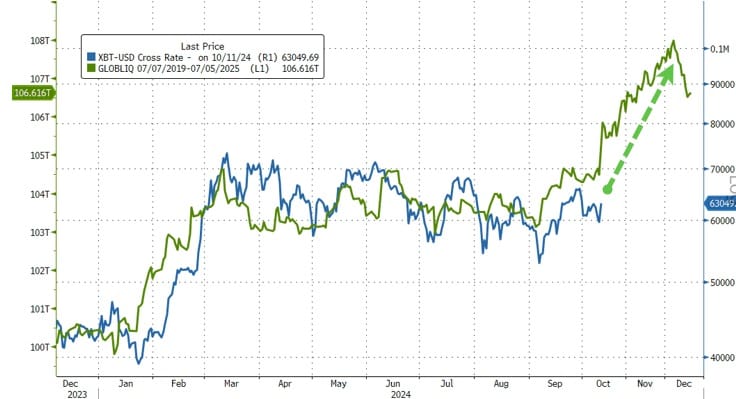

Digital Gold Bitcoin exploded back higher overnight (from $59,000 to $63,000), to end the week solidly in the green (after testing near one-month lows).

Is this the start of Bitcoin's rip on the back of surging liquidity???

Finally, this weekend represents the two year anniversary from the bear market lows. The S&P is up 66% from the lows in October 2022, helped by and endless supply of liquidity from global central planners.

BUT... the last two weeks has seen liquidity start to contract a little (even as stocks soared to record-er highs).

Will the money-printers get back to work... or will stocks sink into the election (which Trump is now leading in all the prediction markets - but not the polls)?

There's no mkt bears left in the world

Have a good weekend!

BULLETin will be back on Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).