Jihadi Preachers

The silence of many surrounding the vile hate speech of Muslim clerics says a lot about the threats within the West.

NASDAQ Surges, Goldgasms to All Time Record High After "Adjusted" PPI Sparks Buying Frenzy

ASX200 Futs current down 29 points

Now this is an illustration of Jedi Spin.

What started off yesterday as another ugly overnight session with US stocks tumbling and yields surging following yesterday's shock inducing CPI print, quickly reversed after the market - in its infinite stupidity - took what was a hot PPI print (core PPI came in at 2.4% vs Exp. 2.2% and up from 2.0%) but which the Biden BLS massaged just enough to make it appear that headline PPI actually missed (coming at 2.1% vs exp 2.2%), on what we earlier showed was blatant (and literal) gaslighting, with the entire miss the result of seasonal adjustments to gasoline prices which "dropped" by 3.6% even though they actually rose 6.3% to the highest price in 6 months.

And while anyone with half a brain could quickly see through the PPI BS bezzle, that clearly did not apply to the algos, such as this one...

... who instead ramped spoos and even though a few of them realised just how stupid the initial move had been and dumped the kneejerk ramp, the remainder - even dumber - went with the flow and shortly after the cash open, stocks went on one of their trademark diagonal ramps higher...

One consequence of today's meltup is that stonks which had until recently been left for dead, like AAPL, enjoyed their best day in almost a year: indeed, AAPL's 4% gain at session highs, was the best intraday performance in over a year...

... and while traditionally AAPL had been used a "carry-trade" funder for other Mag 7 longs, today that was not the case, with NVDA also surging more than 3%, following a similar gain yesterday...

It wasn't just the Mag7s that saw a flood of buying: investors also rushed for what has become the darling trade in recent weeks, gold, which surged to a fresh all time high above US$2,370.

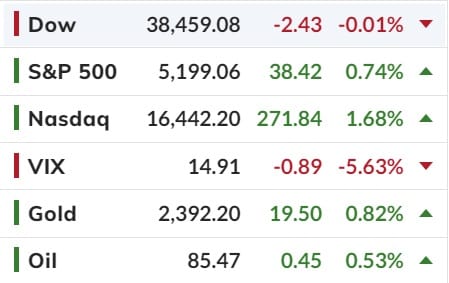

The overnight score board

And this is the concerning part - The one place where there was little buying interest is arguably the most important asset for the market: 10Y yields rose as high as 4.59% and continue to trade in the redzone. Any breakout here and the next stop is 4.75%

We now await the official start of US earnings season tomorrow when the big banks report Q1 results.

Happy Days!

Have a good weekend.

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).