AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

Stagflation Signal Stalls US Stocks while Sparking Gold Gains

Hotter than expected CPI (as food costs reignite) and ugly jobless claims data (somewhat affected by Hurricane Helene) signal stagflationary pressures may be returning.

Not even US lottery tickets are immune to the inflationary disaster created under the Biden/Harris administration.

Mega Millions ticket prices will rise from $2 to $5 in April 2025, but the company - doing its best Stephanie Kelton impression - promises "bigger jackpots" and more chances to win, according to Consumer Affairs.

Of course, they mean bigger nominal jackpots, as by the time the changes are implemented it'll likely cost $50 for your morning coffee, but I digress.

For the 52nd straight month, core consumer prices rose on a MoM basis in September (+0.3% MoM - hotter than the 0.2% expected) - the strongest since March. That left Core CPI YoY up 3.3%, hotter than the 3.2% expected.

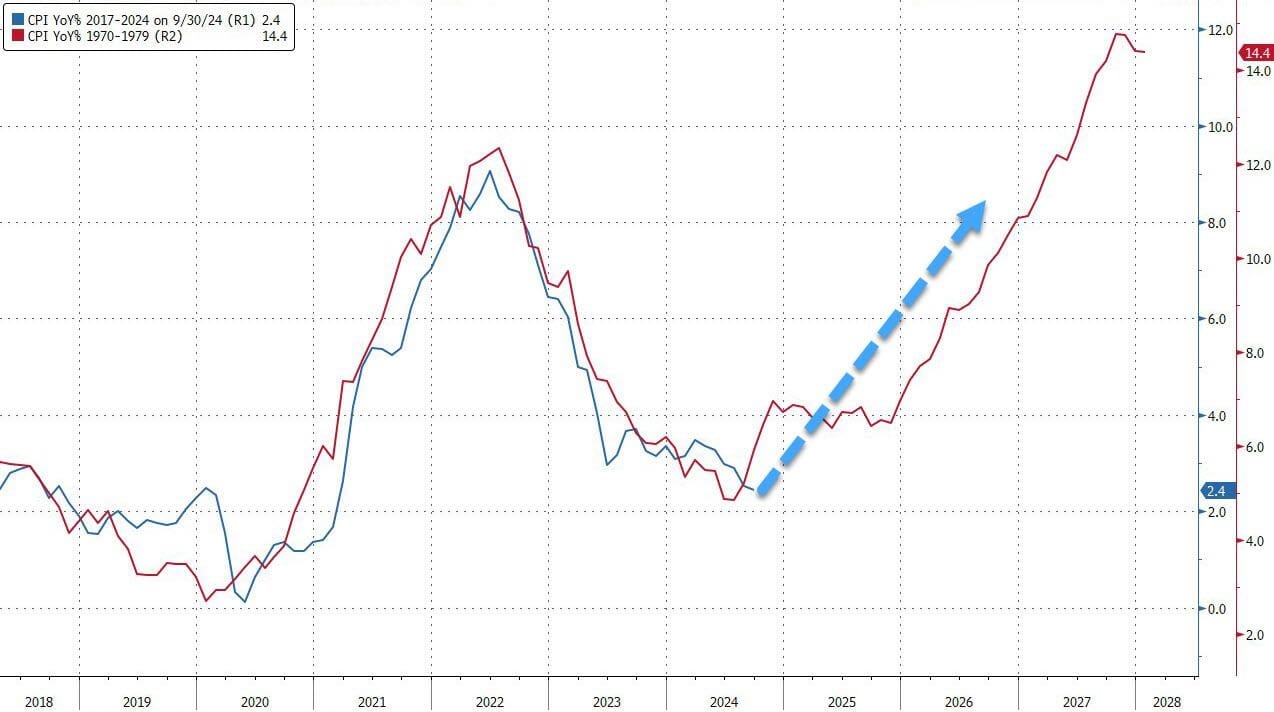

Could the US be really replaying the '70s once again?

Will that really be Powell's legacy? Or will the timing of this resurgence in inflation be perfectly timed to coincide with Trump's election victory?

Anyway US Stocks ended lower (with Small Caps the biggest loser) despite a late-day panic-bid into the close.

The US dollar rallied for the 8th day in a row - the last time this happened, The Fed had just started hiking rates in April 2022.

Despite the US dollar's gains, gold also rallied overnight back to USD $2,646

Bitcoin barfed late on today, back below the USD$60,000 Maginot Line once again (after an SEC lawsuit against digital asset market maker Cumberland DRW sparked more regulatory FUD).

The mixed nature of the overnight data means that traders are trying to express the view that inflation is still a problem, but that the labor market is maybe weakening too, which will mean The Fed goes ahead with rate cuts anyway.

Have a good weekend

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).