AI’s Invasion of Investing

The holy grail of automated investing may actually work against the regular person while empowering the rich and powerful.

So US stocks shrugged off early weakness driven by the right-regime-shift in European elections, treading water on Monday and ahead of a big macro Wednesday, featuring both the May CPI reading and the scheduled June FOMC meeting.

Both the SP500 and NASDAQ closed at ATH's!

Now are are some charts to help illustrate while indices look calm, under the surface things are not going great at all..

This is the biggest gap between the equal- and cap-weighted S&P indices since the peak in 2008/9.

Sticking with the S&P some more did you know that virtually all of the S&P upside has been due to 7, or rather just 1 stock?

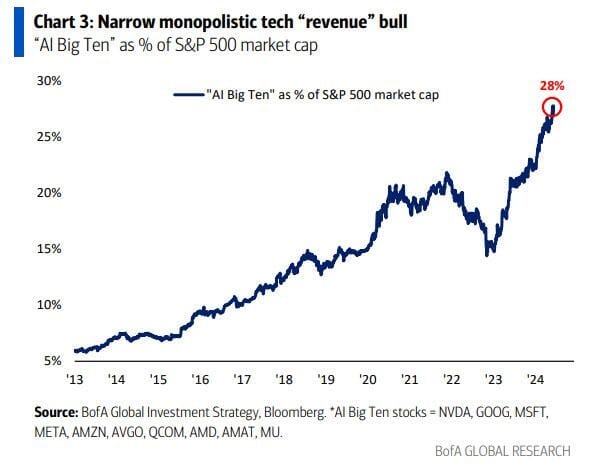

S&P 500 is currently up 12% YTD, but ex-NVDA it is up 7.9%, and ex-"Magnificent 7" up 4.9%, ex-"AI Big Ten"* just up 3.6%.

it seems the US has a narrow monopolistic tech “revenue” bull market, one in which the AI Big Ten market cap is up from $5tn to $13tn since Q1 23 while their revenues has grown only from $1.3tn to $1.5tn.

But while the AI bubble continues to single-handedly support the market, there is little less to prop up assets. In fact, things are actively slowing for the following reasons:

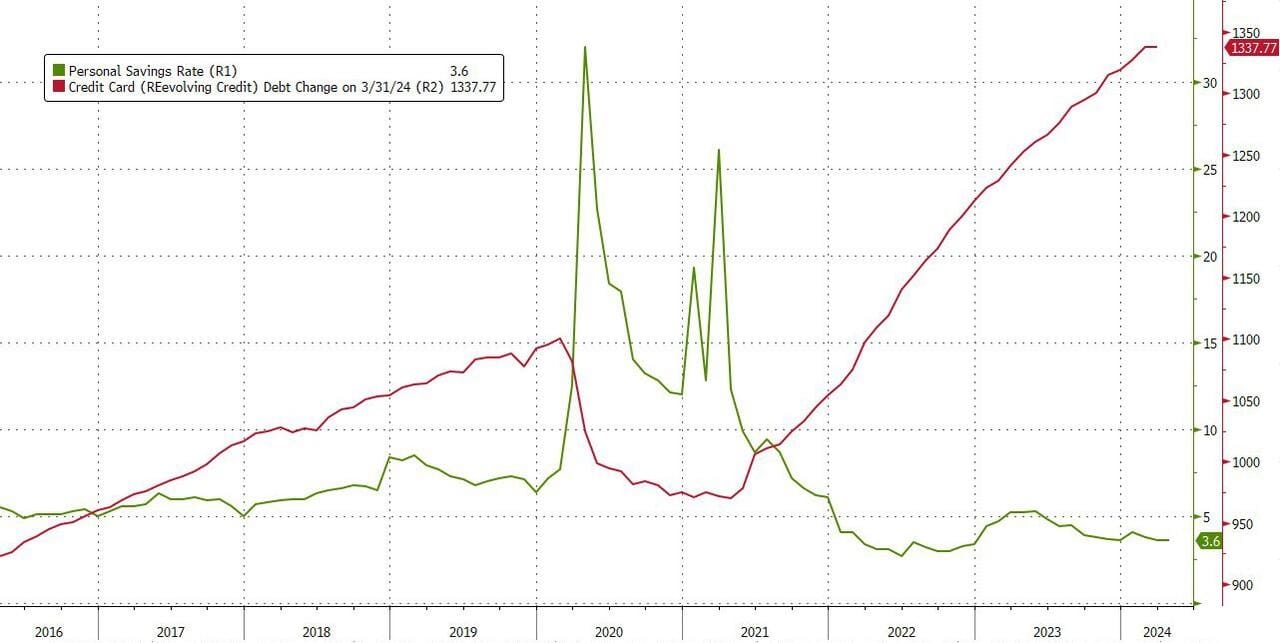

Meanwhile the latest US Consumer credit data, confirmed our fears: the consumer has hit a brick wall.

According to the Federal Reserve's monthly consumer credit report, in April total consumer credit rose $6.4 billion, far below the median estimate of $10 billion, but more notably, the March number was shocking revised from $6.3BN to a negative $1.1BN, the biggest drop since last August when Biden enacted his unconstitutional student debt relief.

The real shocker however was April's revolving credit print - that's credit card debt. It came in at -$0.5BN, it followed last month's puny $1.7BN, and was the first negative number since the COVID crisis!

To get a sense just how rare it is to get a negative credit card debt monthly change, consider that in the six years prior to the covid crash, the US had recorded just 5 months of negative prints, and all tended to precede major draw-downs in the economy. I expect no less this time.

Of course with the Fed refusing to cut rates - for good reason - the brutal slowdown in new credit card debt is hardly a surprise because in Q1 the average rate across all commercial banks on all credit card amounts just hit a new record high of 21.59%, which is a vivid reminder that while banks are happy to hike credit card rates, they rarely if ever cut them, and it's also one of the main reasons why Goldman's trading desk just went bearish on US consumers.

There is only so much more credit card maxing out that can take place before reality finally sets in, as can be seen in the next and perhaps most striking chart yet: total credit card debt is record high while the personal savings rate is record low!

Finally, someone is going to be very wrong here...

Who is your money on?

Because Central Bank liquidity sure ain't supporting it anymore...

You think Nivida will continue to carry the market?

This won't end well.

Happy Tuesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).