A Conversation with God

Our resident mariner, Stuart Ballantyne, imagines a conversation with God in 2028

'All Bets Are Off' - Market-Mayhem after Consumer Prices Crush Dovish Rate Cut Dreams

ASX200 futs are pointing down 65 pts...

"All bets are off" after this morning's hot-hot-hot CPI print

The fourth hotter-than-expected core inflation report in a row got investors reevaluating expectations around the Fed's first rate cut...

After increasing MoM for the last five months, headline CPI was expected to slow modestly in March (from +0.4% MoM to +0.3% MoM), but obviously still rising. However, it did not, rising a hotter than expected 0.4% MoM (equal highest since August 2023) and pushing it up 3.5% YoY...

Core CPI also rose more than expected (+0.4% MoM) pushing the YoY move up 3.8% (hotter than the 3.7% exp)

Tl;dr: Newsquawk sums up today's CPI print...

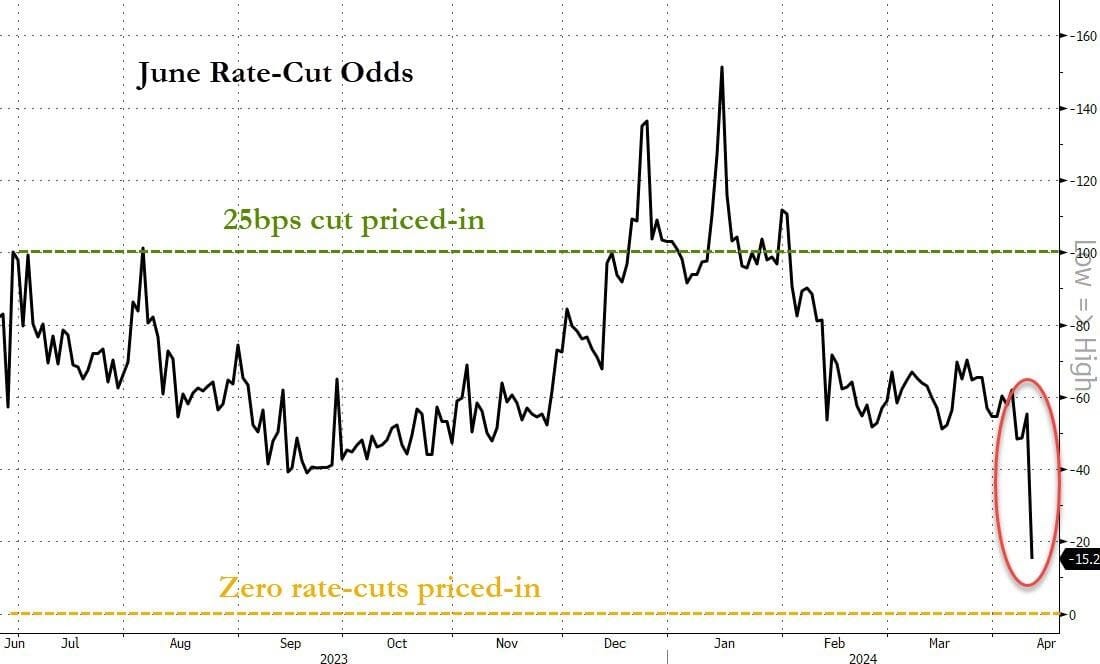

There is now just a 15% chance of a 25bps rate cut for JUN24

Worse - The market is now pricing in just 38bps (1.5 rate-cuts) in 2024...

This is from three rate cuts fully priced in!

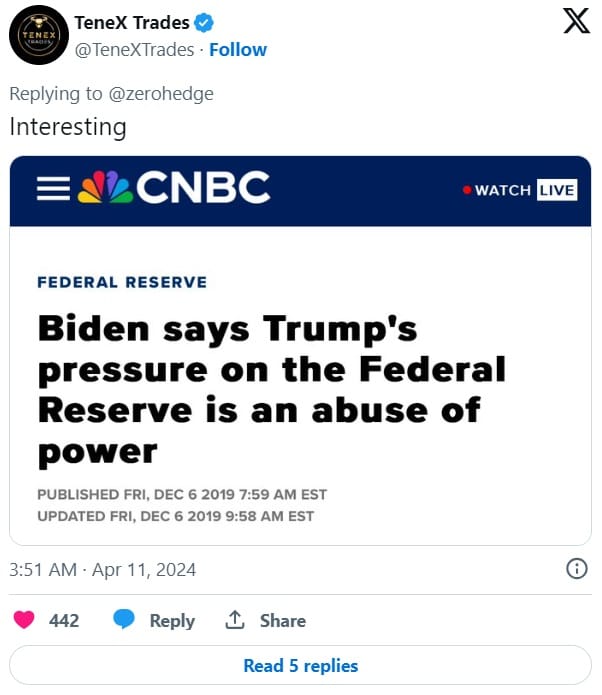

Meanwhile, President Biden chimed in on Fed policy...

“Well, I do stand by my prediction that, before the year is out, there’ll be a rate cut,” Biden said Wednesday at a White House press conference alongside Japanese Prime Minister Fumio Kishida, adding that today's CPI report could delay a rate cut by at least a month...

So much for 'Fed independence!'

Just a reminder

And that all sparked a massive surge in TSY yields with the 2Y Yield got within a tick of 5.00% today for the first time since mid-Nov...

Overnight was the biggest yield jump for the 10Y since Sept 2022, 2Y's biggest absolute jump since March 2023.

The 5Y TSY Yield broke higher than the 30Y yield today (inverted) for the first time since September...

The US dollar soared on the (less dovish and maybe hawkish) CPI print to its highest close since Nov 2023. AUD now just over USD$0.6515 don about 1.5c since yesterday!

The Bank of Japan has a real problem now as USDJPY surged up to 153 - a fresh 34-year-low for the yen against the US dollar.

AUDJPY sits at 99.57 - 16-year-low for the yen against the AU dollar! No wonder Aussies are flocking over to Japan for their Holidays and Skiing!

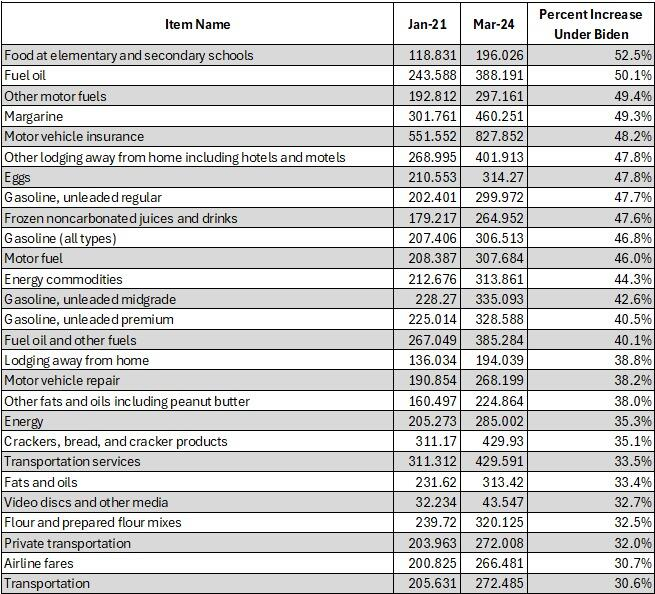

Before we go, I note that US consumer prices have not fallen in a single month since President Biden's term began (July 2022 was the closest with 'unchanged'), which leaves overall prices up over 19% since Bidenomics was unleashed. And prices have never been more expensive...

That is an average of 5.6% per annum (more than triple the 1.9% average per annum rise in price during President Trump's term).

And it's the price of everyday items that Americans cannot cope with Joe...

Are we going to see a replay on the '70s?

Finally, is this gaping wide crocodile's mouth getting ready to snap shut again???

When will rates matter again?

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).