Weekend Open Forum

Here's the place to have a winter weekend party...or a least a heartwarming chat with fellow members!

Crypto Bid, Crude Skids, US Stocks & Bonds Sluggish As CPI Looms for both US and Aust mkts

FYI - I'm in the process of moving house so the BULLETin reports might be a bit sporadic over the next couple of weeks.

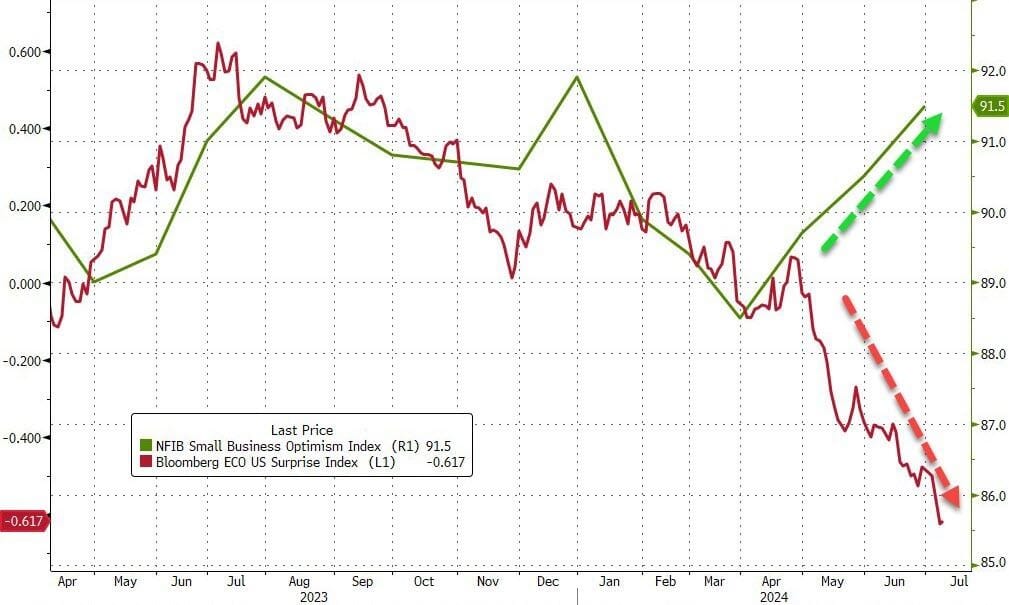

Somehow, Small Business Optimism rose in June (for the third straight month) to its highest since Dec 2023 (maybe Small Business owners had already worked out Biden is a puppet?) despite aggregate economic data collapsing dramatically, PMIs plunging, and even The Fed admitting the labor market is tightening. Does this look normal? We saw a decoupling of this sort in June 2021 after which small business optimism collapsed to fresh cycle lows...

US mkts overnight basically didn't move much.

Goldman Sachs trading floor notes that overall volumes were down (-11% vs the 20dma) noting this is a function of:

1) little micro news flow,

2) non-existent index volatility (see VIX hovering near multi year lows),

3) and investors prepping for earnings.

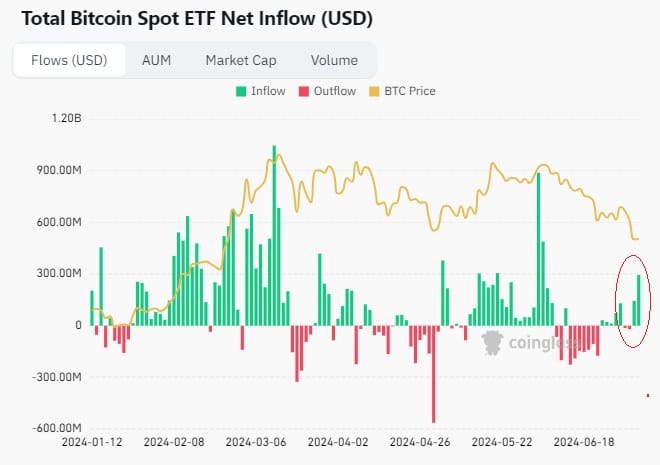

Bitcoin surged back above USD$58,000 overnight after the last couple of days of large ETF inflows...

Gold and the USD limped a little higher while crude dropped a little.

Fed Chair Powell is also speaking this week at the US Senate and so far he's sticking to his script, repeating that more good data would strengthen the FED's confidence on inflation and that elevated inflation is NOT the only risk the Fed faces.

So US CPI due Thursday their time could be the catalyst that sends the mkt moving. Low CPI increases US rate cut chances. Moderate to high inflation then the Fed will do nothing. But here in Australia, the JUN quarterly CPI drops tomorrow and Treasurer Grimm Jim is bracing for a print the same or less than the MAR quarter read of 3.6%

Problem for him (and everyone else) the monthly JUN print was at 4% and if tomorrows print is higher than MAR's 3.6% then the odds are the RBA will Hike rates when they meet in AUG.

Happy Wednesday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).