Angus Taylor Is Not the Answer

Why Angus Taylor represents continuity, not renewal, and cannot rebuild the Liberal base.

Traders Fall Back in Love With Stocks after Terrible-Tuesday, Bitcoin Breaks Above USD$50k

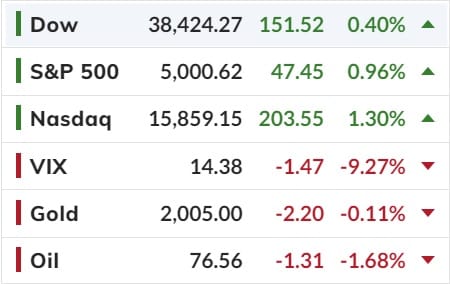

A quiet macro day allowed a post-VIXperation market room to do what it does best, 'sell-vol, and bid stocks' as the US majors did their best to erase yesterday's ugliness and VIX puked back to a 14 handle.

Because, well why not... love is in the air...in the US!

VIX actually began to lose its lollies right after the cash close on Tuesday night...

The Nasdaq rallied back into the green post-CPI and the S&P 500 got close, Small Caps are still laggards but made up a lot of ground from Terrible Tuesday...

Given the exuberance in bonds and stocks, we note that rate-cut expectations barely budged with June still the most likely timing for the first rate-cut...and the market is still pricing in less than 4 rate-cuts this year.

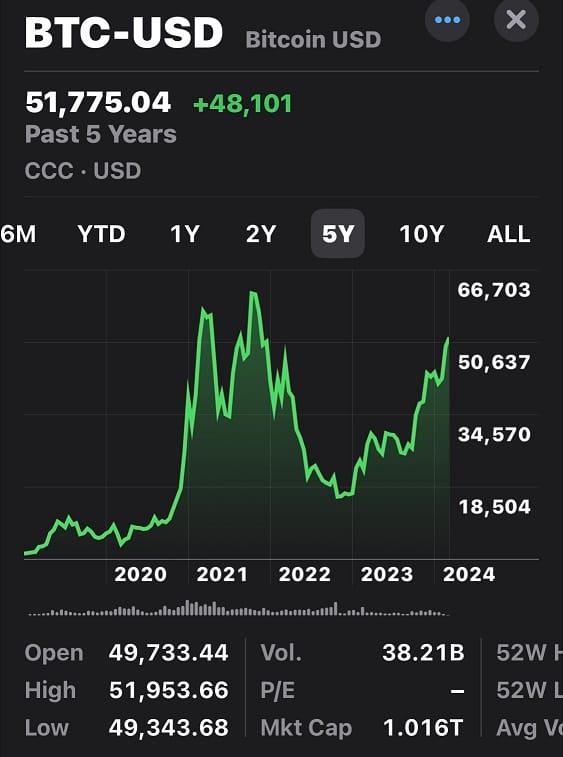

Bitcoin not only soared back above $52,000 today for the first time since December 2021 it's mkt cap is now over USD$1 trillion dollars...

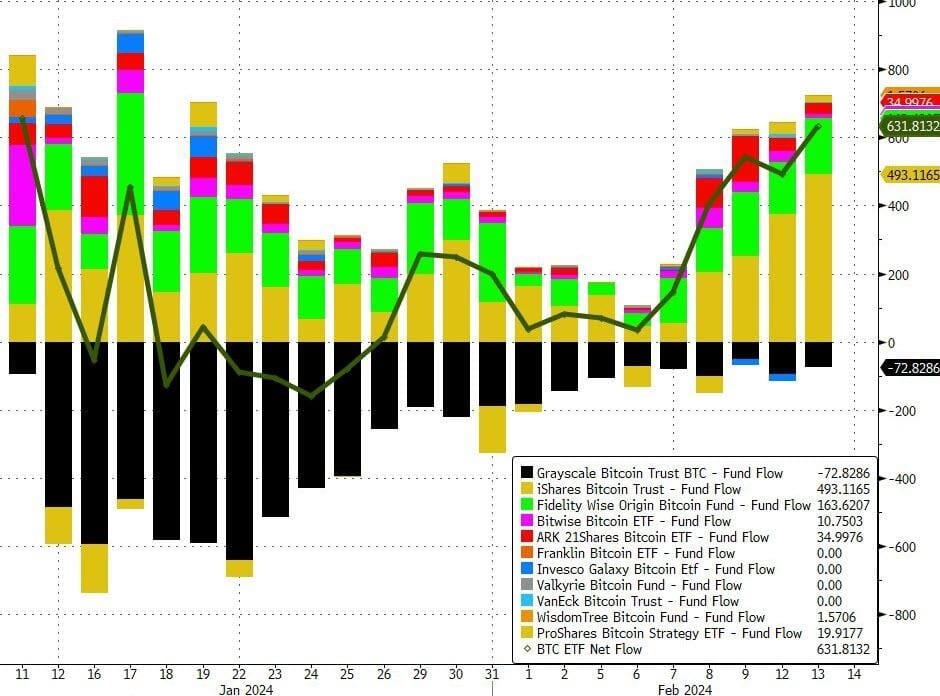

Remember that key word - Inflows!

As Bitcoin ETF inflows hit a new high since inception (now almost $4 billion since inception)...

The ETF's are basically buying 10X what the Bitcoin Miners can sell. Last night over USD$631 million (most of which went to Blackrocks' ETF) of new money came into the worlds most secure blockchain network.

While inflows - my key word - are not only positive inflows but increasing inflows, Bitcoin, along with this insanely valued Tech mkt will trade higher and higher.

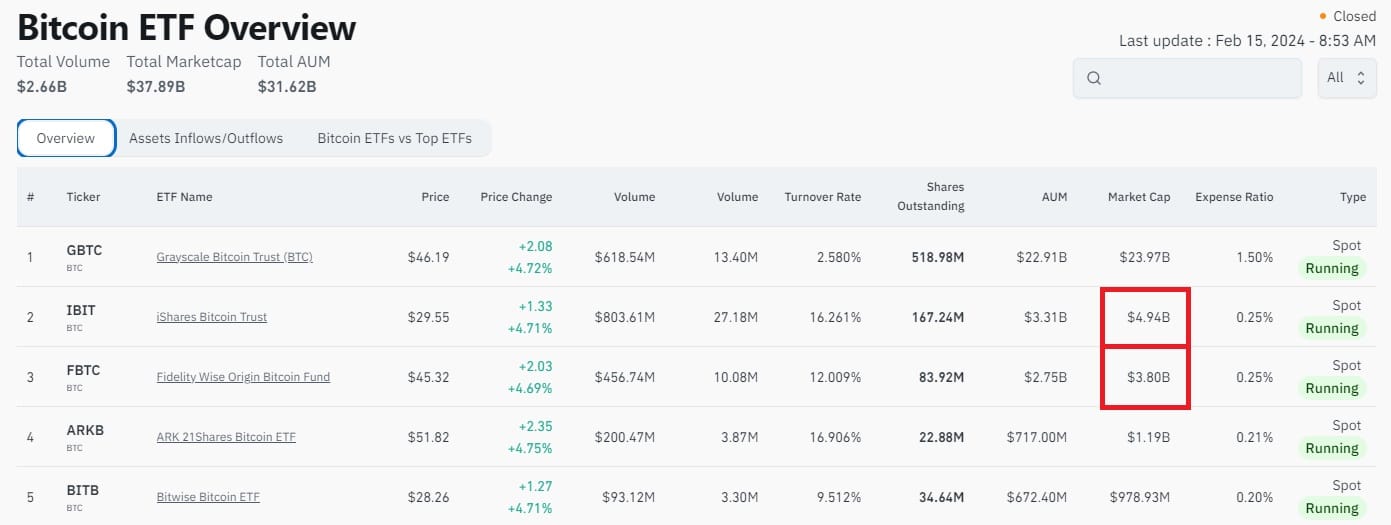

It's impressive that the 2nd and 3rd largest ETF's have nearly USD$5bn and USD$4bn mkt caps respectfully.

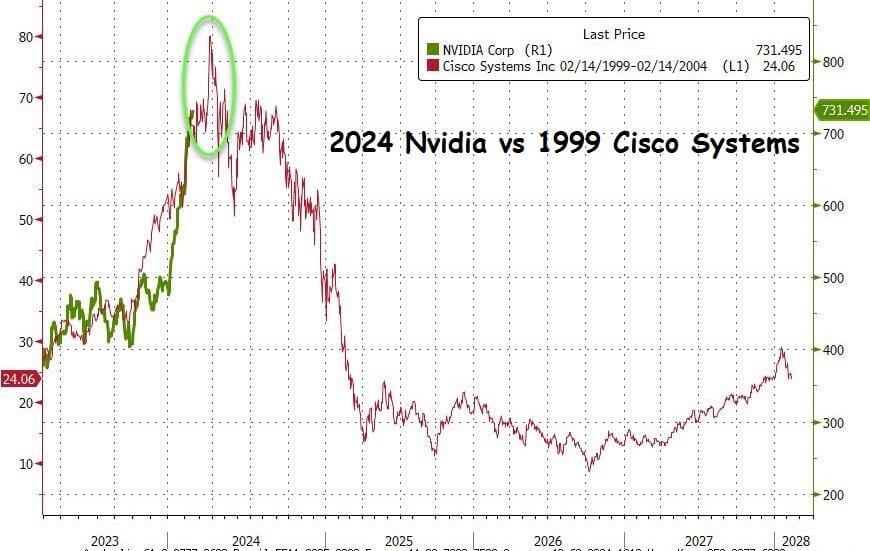

Finally, one more leg higher in NVDA?

And if NVDA goes, all the king's horses and all the king's men go bye bye...

...It can't be that easy, right?

Today is also FEB2024 Options Expiry.

Happy Thursday!

This information contains unsolicited general information only, without regard to any individual’s investment objectives, financial situation or needs. It is not specific advice for any particular investor or trader. Investment in the stock market involves risk.

This information may not take into account your investment objectives or financial situation, and you should obtain advice based on your own individual circumstances before making an investment decision.

This information is made available to you by ANDIKA Pty Ltd ABN 41 117 403 326, a licensed securities and derivatives dealer (AFSL # 297069).

Join 50K+ readers of the no spin Weekly Dose of Common Sense email. It's FREE and published every Wednesday since 2009